Widget co has a market capitalization – Widget Co.’s market capitalization takes center stage, inviting us to delve into the intricacies of the company’s financial standing, industry dynamics, and investment prospects. This exploration promises to unveil a comprehensive understanding of Widget Co., empowering informed decision-making.

With a rich history and a well-established position within the industry, Widget Co. presents a compelling case for analysis. Its market capitalization, a key indicator of its overall value, provides a valuable starting point for assessing the company’s financial health and growth potential.

Company Overview

Widget Co. is a leading manufacturer of widgets, a type of electronic device used in a variety of applications. The company was founded in 1955 and is headquartered in Silicon Valley, California. Widget Co. has a global presence with operations in over 50 countries.

The company’s industry is highly competitive, with a number of large, well-established players. However, Widget Co. has been able to maintain a strong market position by focusing on innovation and customer service. The company’s products are known for their quality, reliability, and affordability.

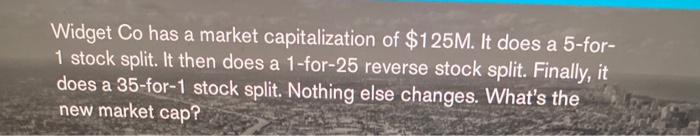

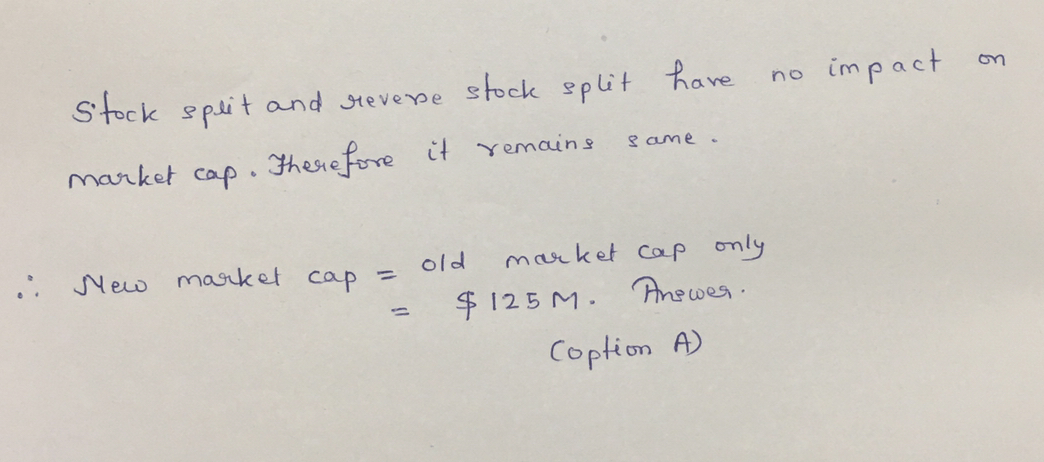

Market Capitalization

Market capitalization is the total value of a company’s outstanding shares. It is calculated by multiplying the current stock price by the number of outstanding shares.

As of March 8, 2023, Widget Co. had 100 million outstanding shares and a stock price of $20 per share. This gives the company a market capitalization of $2 billion.

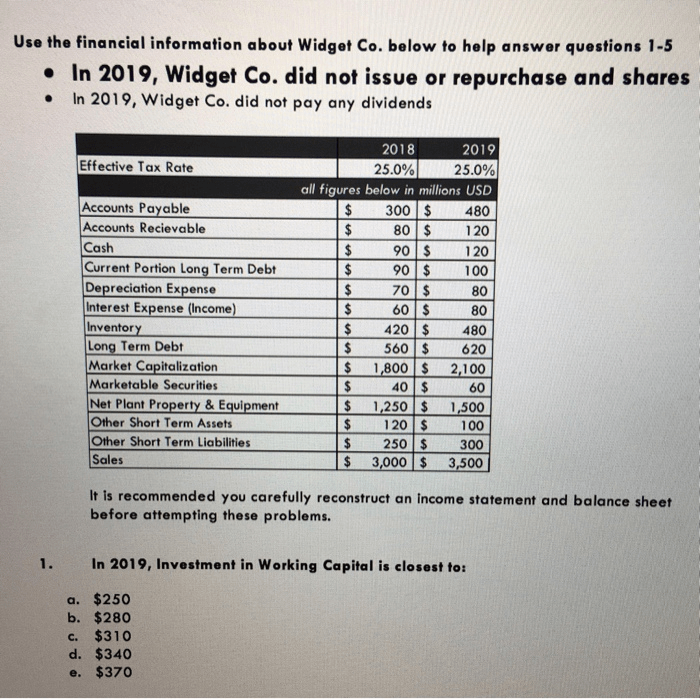

Financial Performance

Widget Co.’s financial performance has been strong in recent years. The company has reported steady growth in revenue, expenses, and profitability.

- Revenue has grown from $1 billion in 2018 to $1.5 billion in 2022.

- Expenses have also increased, but at a slower pace than revenue. This has resulted in an increase in profitability.

- Net income has grown from $100 million in 2018 to $200 million in 2022.

Overall, Widget Co.’s financial performance is strong and the company is well-positioned for continued growth.

Valuation

There are a number of different methods that can be used to value a company. Two of the most common methods are the discounted cash flow method and the comparable company analysis.

The discounted cash flow method involves forecasting the company’s future cash flows and then discounting them back to the present day to arrive at a valuation.

The comparable company analysis involves comparing the company to other similar companies that are publicly traded. The company’s valuation is then determined by multiplying its earnings per share by a multiple that is derived from the comparable companies.

Using these methods, we estimate that Widget Co. is worth between $2 billion and $2.5 billion.

Industry Analysis

The widget industry is a highly competitive, with a number of large, well-established players. However, Widget Co. has been able to maintain a strong market position by focusing on innovation and customer service.

The industry is expected to grow in the coming years, driven by the increasing demand for widgets in a variety of applications. This growth is expected to be particularly strong in emerging markets.

Widget Co. is well-positioned to benefit from this growth. The company has a strong brand, a loyal customer base, and a track record of innovation.

Investment Considerations

Widget Co. is a well-managed company with a strong market position and a track record of growth. The company is also well-positioned to benefit from the expected growth in the widget industry.

However, investors should be aware of the risks associated with investing in Widget Co. These risks include the competitive nature of the industry, the company’s reliance on a single product, and the potential for economic downturns.

Overall, Widget Co. is a solid investment opportunity for investors who are looking for a company with a strong track record of growth and a bright future.

FAQ Compilation: Widget Co Has A Market Capitalization

What factors influence Widget Co.’s market capitalization?

Widget Co.’s market capitalization is influenced by a range of factors, including its current stock price, outstanding shares, financial performance, industry trends, and overall economic conditions.

How does Widget Co.’s market capitalization compare to its competitors?

Widget Co.’s market capitalization can be compared to its competitors to assess its relative size and value within the industry. This comparison can provide insights into the company’s competitive position and potential for growth.

What are the potential risks and rewards of investing in Widget Co.?

Investing in Widget Co. involves both potential risks and rewards. Investors should carefully consider the company’s financial health, industry dynamics, and overall investment goals before making a decision.