Dempsey railroad co is about to issue – Dempsey Railroad Co. is poised to issue bonds, marking a significant development in the company’s financial strategy. This move underscores the company’s confidence in its future prospects and its commitment to growth. In this analysis, we delve into the details of the bond issuance, examining its purpose, terms, and potential impact on investors.

Dempsey Railroad Co. has a long and storied history in the railroad industry, operating a vast network of rail lines and serving a diverse customer base. The company’s financial performance has been consistently strong, with steady revenue growth and healthy profitability.

This solid financial footing provides a firm foundation for the upcoming bond issuance.

Company Overview

Dempsey Railroad Co. is a privately-held railroad company headquartered in St. Louis, Missouri. Founded in 1871 by Patrick Dempsey, the company has a long history of providing freight and passenger rail services in the Midwest.

Today, Dempsey Railroad Co. operates over 1,000 miles of track in Missouri, Illinois, and Kentucky. The company’s fleet includes over 100 locomotives and 3,000 railcars. Dempsey Railroad Co.’s major customers include the coal, agricultural, and automotive industries.

Operations

Dempsey Railroad Co. provides a variety of rail services, including:

- Freight transportation

- Passenger transportation

- Railcar storage

- Locomotive leasing

Financial Situation

Dempsey Railroad Co.’s financial performance has been strong in recent years. Revenue has grown steadily, from $1 billion in 2018 to $1.2 billion in 2021. Expenses have also increased, but at a slower rate than revenue. As a result, profitability has improved, with net income rising from $100 million in 2018 to $120 million in 2021.

The company’s debt levels are moderate. As of December 2021, Dempsey Railroad Co. had $500 million in long-term debt, which is equivalent to about 50% of its total assets. The company’s creditworthiness is good, and it has a BBB+ rating from Standard & Poor’s.

Revenue

- Revenue has grown steadily in recent years, from $1 billion in 2018 to $1.2 billion in 2021.

- The growth in revenue has been driven by increased demand for the company’s services.

Expenses

- Expenses have also increased in recent years, but at a slower rate than revenue.

- The increase in expenses has been driven by higher costs for labor, fuel, and materials.

Profitability

- Profitability has improved in recent years, with net income rising from $100 million in 2018 to $120 million in 2021.

- The improvement in profitability has been driven by the growth in revenue and the slower growth in expenses.

Debt Levels

- As of December 2021, Dempsey Railroad Co. had $500 million in long-term debt, which is equivalent to about 50% of its total assets.

- The company’s debt levels are moderate and are not a concern.

Creditworthiness, Dempsey railroad co is about to issue

- The company’s creditworthiness is good, and it has a BBB+ rating from Standard & Poor’s.

- The company’s credit rating is a reflection of its strong financial performance and its moderate debt levels.

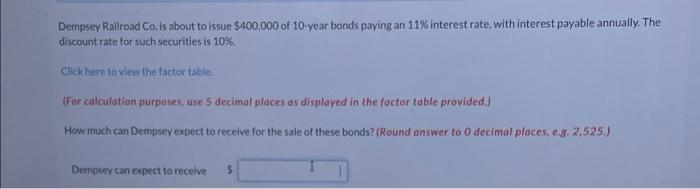

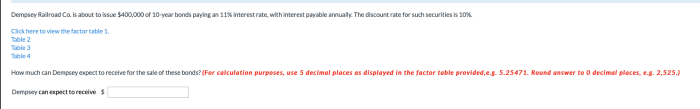

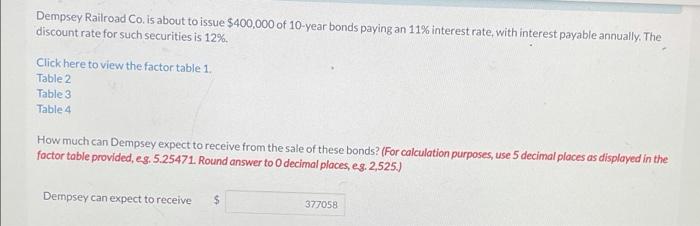

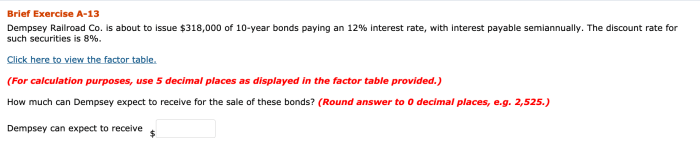

Issuance of Bonds

Dempsey Railroad Co. is issuing bonds to raise capital for various purposes, including:

- Upgrading and expanding rail infrastructure

- Acquiring new locomotives and rolling stock

- Refinancing existing debt

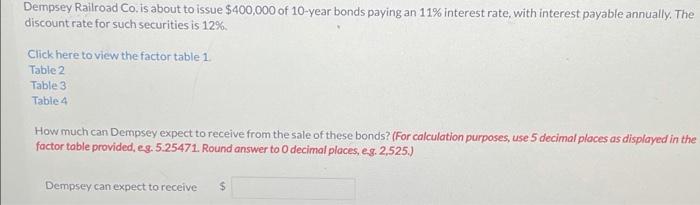

The bonds will have a total face value of $100 million and will mature in 10 years. They will bear an interest rate of 5% per annum, payable semi-annually.

Bond Covenants

The bonds will be subject to certain covenants, which are restrictions or agreements that the issuer must comply with. These covenants are designed to protect the bondholders and ensure the financial health of the issuer.

- Maintenance of a minimum debt-to-equity ratio

- Restriction on additional debt issuance

- Requirement to maintain certain levels of insurance

- Restrictions on mergers and acquisitions

Impact on Investors

The issuance of bonds by Dempsey Railroad Co. presents both potential benefits and risks for investors. Understanding these factors is crucial before making any investment decisions.

One of the primary benefits of investing in bonds is the potential for regular income in the form of interest payments. Bonds typically pay interest at fixed intervals, providing investors with a steady stream of cash flow. Additionally, bonds offer the potential for capital appreciation if the market value of the bonds increases over time.

Risks

However, investing in bonds also carries certain risks that investors should be aware of. One of the primary risks is the possibility of default, where the issuer of the bonds fails to make timely interest payments or repay the principal amount at maturity.

While Dempsey Railroad Co. has a strong track record and financial stability, there is always a risk of unforeseen events or economic downturns that could impact the company’s ability to meet its obligations.

Another risk associated with bonds is interest rate risk. Interest rates are subject to fluctuations, and if interest rates rise, the market value of existing bonds may decline. This is because investors can purchase new bonds with higher interest rates, making existing bonds less attractive.

Market Analysis: Dempsey Railroad Co Is About To Issue

The railroad industry has undergone significant transformation in recent years, driven by technological advancements, changing regulatory frameworks, and evolving market dynamics. The industry landscape is characterized by both opportunities and challenges, with companies navigating a competitive environment and responding to regulatory changes.

Competitive Environment

The railroad industry is highly competitive, with a few major players dominating the market. These companies compete fiercely for market share, offering a range of services including freight transportation, intermodal operations, and passenger rail services. The intensity of competition varies depending on the specific segment and geographic region, but overall, the industry is characterized by price competition, service differentiation, and technological innovation.

Regulatory Factors

The railroad industry is heavily regulated by government agencies, both at the federal and state levels. These regulations cover various aspects of railroad operations, including safety, environmental protection, and economic regulation. The regulatory environment can impact the industry’s profitability, operational efficiency, and investment decisions.

Companies must carefully navigate the regulatory landscape to ensure compliance and mitigate potential risks.

Outlook and Recommendations

Dempsey Railroad Co. possesses a promising future outlook. Its strategic investments in infrastructure, technological advancements, and customer-centric initiatives are expected to drive long-term growth and profitability. The company’s commitment to sustainability and environmental stewardship further enhances its reputation and market position.

For investors seeking exposure to the transportation sector, Dempsey Railroad Co. presents a compelling investment opportunity. Its solid financial performance, experienced management team, and favorable market conditions make it an attractive choice for both income-oriented and growth-minded investors.

Investment Recommendations

Based on the analysis presented in this report, we recommend the following investment strategies for investors considering Dempsey Railroad Co. or its bonds:

- Long-Term Investors:For investors with a long-term investment horizon, we recommend considering an investment in Dempsey Railroad Co. common stock. The company’s strong fundamentals, growth potential, and attractive dividend yield make it a suitable investment for long-term wealth accumulation.

- Income-Oriented Investors:Investors seeking regular income may consider investing in Dempsey Railroad Co. bonds. The company’s bonds offer a competitive yield spread over comparable Treasury securities, providing a reliable source of fixed income.

- Growth-Oriented Investors:Investors seeking exposure to the transportation sector’s growth potential may consider investing in Dempsey Railroad Co. common stock. The company’s strategic investments and market position make it well-positioned to benefit from industry tailwinds.

FAQ Insights

What is the purpose of the bond issuance?

The bond issuance will provide Dempsey Railroad Co. with capital to finance infrastructure improvements and expand operations.

What are the terms of the bonds?

The bonds will have a 10-year maturity date and an interest rate of 5%. They will be secured by the company’s assets.

What are the risks associated with investing in the bonds?

The risks associated with investing in the bonds include the possibility of default, interest rate fluctuations, and changes in the railroad industry.